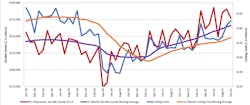

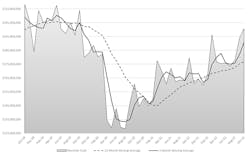

Machine-shop activity drove cutting-tool consumption up 3.4% from September to October, up 11.7% from October 2021. According to the latest release of the monthly Cutting Tool Market Report, the value of cutting tools consumed in October was $200.6 million, bringing the year-to-date consumption total to $1.8 billion, 9.4% higher than last year’s January-October total.

The report is compiled jointly by the U.S. Cutting Tool Institute and AMT – the Assn. for Manufacturing Technology.“Market conditions for the cutting tool industry remain positive,” according to Jeff Major, president of USCTI. “Overall year-to-date sales versus 2021 are up 9.4%. Cutting tool sales for 2023 are expected to remain positive, led by the automotive and aerospace market segments. Shipping costs have stabilized somewhat, which helps our overall business, while there still remains some uncertainty with raw material costs.”

CTMR data, which represents actual purchases of cutting tools reported by companies that comprise a majority of the domestic market for cutting tools, serves as an index to overall manufacturing activity due to the range of market segments driving shops’ consumption of cutting tools.

While the consumption of cutting tools had been weakening since the start of Q2 2022, slowed by supply-chain disfunctions and rising inflation that reduced purchasing activity and demand for manufactured parts, the start of Q4 is a positive turn.“Cutting tool orders continue to climb even through rocky waters. Certainly, we are all bracing for the impact of the interest-rate increases by the Federal Reserve,” offered Steve Stokey, executive vice president and owner of Allied Machine and Engineering.

“The real key for our industry will be how durable goods perform in the months ahead,” Stokey continued. “If durable goods production continues to grow, our industry may be able to stay in positive territory through an overall slowing economy.”